Introduction

For brand-new drivers, entering the world of auto insurance can seem like an overwhelming job. With many options readily available, understanding the nuances of affordable auto insurance becomes essential. Whether you're fresh out of driving school or simply received your certificate, browsing this complicated landscape is important to guarantee both safety and security and financial cost savings. This extensive guide delves into numerous facets of protecting cheap auto insurance, highlighting strategies to help new motorists save cash while obtaining the essential coverage.

The Roadway to Financial savings: Browsing Affordable Auto Insurance for New Drivers

When it boils down to it, the roadway to savings does not need to be bumpy. As a matter of fact, with proper knowledge and prep work, you can easily discover affordable auto insurance that fits your demands without breaking the bank. The very first step in this trip involves understanding what auto insurance is and why it is essential for new drivers.

What is Auto Insurance?

Auto insurance coverage is an agreement in between you and an insurance company that offers monetary defense versus physical damage or physical injury resulting from web traffic collisions. It might also provide insurance coverage for burglary and various other vehicle-related losses. For new drivers, having appropriate car insurance not just shields their investment but also fulfills lawful demands mandated by a lot of states.

Why Do New Chauffeurs Need Auto Insurance?

Legal Requirement: In numerous places, driving without insurance policy can lead to substantial fines and penalties. Financial Protection: Accidents can take place anytime; having insurance coverage suggests you're not solely in charge of covering repair service costs. Peace of Mind: Recognizing that you're covered in case of a crash can significantly minimize anxiety while on the road.Understanding Kinds of Coverage

Before looking for affordable auto insurance, it's essential to comprehend the different types of insurance coverage readily available:

Liability Coverage

Liability protection is frequently required by law and covers problems you might trigger to others in a mishap. It typically includes:

- Bodily Injury Obligation: Covers medical expenses for injuries suffered by various other parties. Property Damages Responsibility: Covers problems to someone else's property.

Collision Coverage

This type assists spend for fixings to your vehicle after a mishap, no matter who went to fault.

Comprehensive Coverage

Comprehensive protection safeguards against non-collision incidents like theft, vandalism, or natural disasters.

Uninsured/ Underinsured Motorist Coverage

If you're struck by somebody with insufficient or no insurance coverage, this coverage allows you to recuperate prices connected with injuries or damages.

Insurance Navy Brokers Palos Hills ILFactors Influencing Auto Insurance Rates

Understanding what influences your costs can equip you as a brand-new chauffeur looking for inexpensive options:

Driving History

A clean document will certainly help reduce your costs contrasted to individuals with several mishaps or violations.

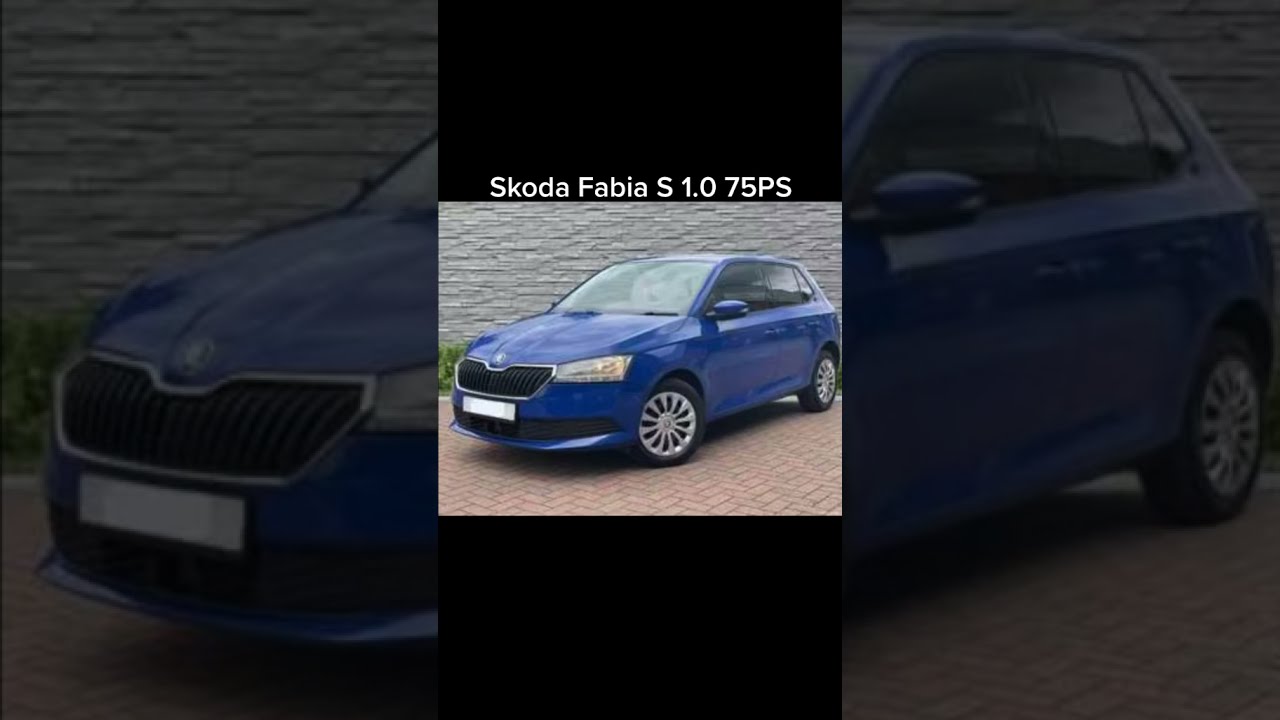

Type of Vehicle

The make and design considerably affect rates; high-end cars usually feature higher costs as a result of fix costs.

Location

Where you live issues. Urban locations generally experience more crashes than country ones, resulting in increased rates.

Age and Experience Level

Younger motorists usually deal with higher costs as a result of lack of experience behind the wheel.

Tips for Locating Affordable Vehicle Insurance

Finding affordable auto insurance isn't difficult; right here are some pointers particularly tailored for brand-new motorists:

Shop Around

Different companies use differing prices based upon their underwriting requirements. Use on the internet contrast tools that allow you to examine numerous quotes at once.

Look for Discounts

Many insurers provide price cuts that can substantially decrease your costs:

- Good trainee discounts Safe chauffeur discounts Bundling policies (like home and auto)

Consider Boosting Your Deductible

Raising your insurance deductible-- the amount you'll pay out-of-pocket prior to coverage starts-- can reduce your month-to-month premium significantly.

Maintain Excellent Credit history Score

Insurers usually use credit history as a factor when establishing rates; maintaining excellent credit can bring about far better deals on car insurance.

Navigating State Requirements for Auto Insurance

Each state has special laws pertaining to minimum needed auto insurance protection:

Minimum Coverage Requirements by State

|State|Minimum Responsibility Coverage|| --------------|-----------------------------------|| California|$15K/ $30K/ $5K|| Texas|$30K/ $60K/ $25K|| Florida|$10K/ $20K|

Make sure you're familiar with your state's requirements prior to acquiring a policy!

The Function of Credit Scores in Auto Insurance Rates

Many consumers don't recognize just how much their credit history affects their car insurance premiums. Right here's why it matters:

Insurers check out a high credit report as an indicator of responsibility. Low credit report may indicate higher danger leading insurance firms to charge higher premiums. Improving your credit rating with time can result in considerable financial savings on car insurance premiums.Frequently Asked Concerns concerning Economical Vehicle Insurance

1. What is considered "inexpensive" automobile insurance?

Affordable auto insurance differs by private situations however usually refers to policies priced within a person's budget while supplying adequate insurance coverage levels based upon state laws and personal needs.

2. Can I obtain cheap auto insurance if I have poor credit?

Yes! While poor debt may boost costs somewhat, several insurance firms recognize other factors such as driving history which might assist you protect a lot more competitive prices in spite of a less-than-perfect score.

3. How do I understand how much protection I really need?

Assessing personal properties and taking into consideration potential risks permits individuals to identify ideal coverage levels; getting in touch with a representative focusing on brand-new drivers can additionally supply understandings customized especially for you!

4. Is it worth it to pack my car and home insurance?

Absolutely! Packing usually leads not just better ease but additionally significant price cuts on both plans-- a win-win situation!

5. What takes place if I allow my policy lapse?

Letting an automobile policy gap can result in prompt monetary consequences such as obtaining fines from neighborhood authorities along direct exposure responsibility risks during any kind of prospective mishaps taking place without active protection!

6. Ought to I consider usage-based or pay-per-mile policies?

Usage-based programs award risk-free driving behaviors with telematics gadgets tracking actions while potentially supplying lower premiums for infrequent users-- an excellent selection if looking towards lessening overall costs!

Conclusion: Driving In the direction of Cost Savings with Economical Auto Insurance

Navigating affordable auto insurance does not have to be overwhelming or complicated if come close to intelligently! By comprehending numerous sorts of protections offered combined with factors influencing prices-- new chauffeurs are equipped properly making notified decisions throughout policy selection refines eventually ensuring ideal financial savings along streets in advance! Bear in mind always speak with specialists when uncertainties occur additionally boosting self-confidence throughout whole journey in the direction of finding ideal fit ensuring tranquility mind every mile traveled ahead!

In recap, The Roadway to Cost Savings: Browsing Affordable Auto Insurance for New Drivers entails thorough research paired consideration individual conditions together with attentive planning ultimately paving method protected dependable affordable options guarding investments moving on successfully!